Commercial Real Estate-Dubai (Office Market)

Overview

Dubai commercial real estate sector has been mostly driven on the basis of the office leasing and sales transactions. Dubai has roughly a stock of 105 million square feet of office space spread across Downtown, Sheikh Zayed Road 1 (SZR 1), Sheikh Zayed Road 2 (SZR 2), Business Bay, Dubai International Financial Centre (DIFC), Jumeirah Lake Towers (JLT), Jebel Ali Free Zone (JAFZA), Dubai World Central (DWC), Barsha Heights, Bur Dubai, Garhoud, Deira, Dubai Healthcare City (DHCC), Dubai World Trade Centre (DWTC), TECOM, Dubai Media City. Dubai added 1.8 million square feet in 2020 with ICD Brookfield Place being the latest entrant as a Grade A, Prime office stock. The office space can be divided into two broad categories.

1. Grade A, Prime Office Stock -34 Million Square Feet

2. Grade B & C Office stock -71 Million Square Feet

Market Outlook (Q4,2020):

Occupancy:

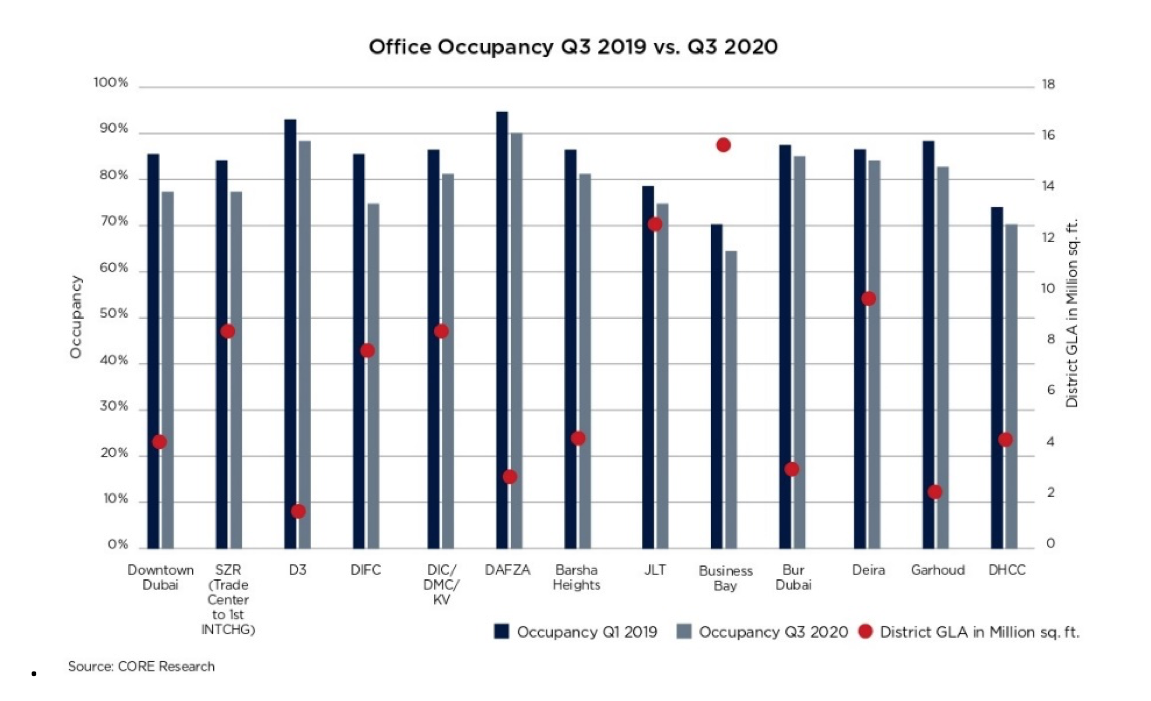

Out of 105 Million Sq.Ft., 25 Million sq. ft space is vacant. Most of the areas witnessed a downward trend in occupancy. Dubai International Financial Centre (DIFC) and Sheikh Zayed Road (SZR) saw an average occupancy drop of 10% and 8% respectively and other areas showed a 5% drop due to downsizing and relocation. Generally Grade A, Prime office stocks show resilience for both occupancy and price.

Sales & Rental:

With the sanctions lifted and a market opportunity presenting itself due to availability and price Q3,2020. Business bay is leading the way with attractive price ranges of AED 550 to 900 Per Sq.ft. Jumeirah Lake Towers (JLT) as free zone was also an attractive option with a range of AED 300 to 800 PSF. Rental rates are now moving towards a stabilization after the year saw an erratic downward trend. The outlook looks positive with the Real Estate Regulatory Agency (RERA) has started working on a unified Commercial Rental Index which was announced in December which will help the commercial sector in regulating and stabilizing the rents.

Trends:

- Most of the demand came from consolidation of space post Covid-19 recovery and relocation.

- Most of the demands came from SME sectors.

- As expected the biggest share in demand is for Business Bay due to the factors of price, availability and location preference.

- Enquiries for offices for sub 2000 Sq. ft has seen many fold increase.

Decision drivers:

Current trend shows tenants preferring fitted and partitioned offices if possible furnished to save costs and get the best out of current market condition.

Landlords showed flexibility for prices for both sales and rentals, payment frequency. Landlords now prefer to retain the tenants to avoid long periods of vacancy.

The overall outlook for the office business looks positive as Dubai looks to gear up for Expo especially with the efficient and successful handling of Covid-19 situation by the government and opening up of the region keeping Dubai at the forefront of most attractive destinations for business.