Dubai: The UAE and Qatar have greater fiscal strength than their other GCC peers, thanks to their large sovereign wealth fund (SWF) buffers relative to their fiscal deficits, according to rating agency Moody’s.

The COVID-19 related fall in oil revenue has eroded fiscal strength of many GCC countries and constrained economic recovery, resulting in lingering pressure on their sovereign credit strengths, according to Moody’s.

The rating agency expects that it will take 2-3 years for real GDP in GCC sovereigns to return to pre-pandemic levels.

“Our negative outlook for GCC sovereigns reflects the coronavirus pandemic’s impact on oil revenue and our expectations for the erosion of fiscal strength experienced last year to extend throughout 2021,” said Thaddeus Best, a Moody’s Analyst.

“The still elevated cost of funding for lower-rated sovereigns in the region will amplify these strains.”

Lower spending

Moody’s expects subdued oil revenue will constrain government spending in 2021. Global oil demand is vulnerable to any subsequent flare-ups in the coronavirus outbreak and further government lockdowns, which could hurt oil prices and delay the planned easing of production cuts by the Organization of the Petroleum Exporting Countries (OPEC).

Analysts said the Capacity of GCC sovereigns to reduce expenditure after drop in oil prices is strongly correlated with institutional strength.

“We estimate that the UAE and Qatar – which have the strongest institutions and governance scores in the region – made the largest cuts to expenditure in 2020. We expect that this discipline will persist throughout 2021, with spending remaining significantly below pre-pandemic levels, despite a year-on-year increase in the UAE,” said Best.

In Saudi Arabia, the government is likely to push through spending cuts in 2021 after coronavirus-related costs delayed a planned tightening in expenditure in 2020.

Limited market access will keep Oman’s expenditure low. The government announced several fiscal consolidation measures in 2020, which it is likely to maintain into 2021. These include a 10 per cent cut in noninterest spending – double what it committed to in March 2020 – and government wage bill reforms. It will also introduce value added tax (VAT) in April 2021.

Spending is forecast to stay above pre-pandemic levels in Kuwait and Bahrain, largely driven by public sector wage bills in Kuwait and already committed 2020 budget spending in Bahrain.

Elevated deficits

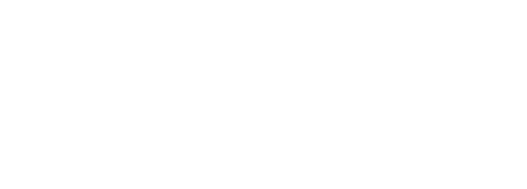

Moody’s expects GCC fiscal deficits to narrow only modestly in GCC in 2021.

“We forecast the median fiscal deficit to remain wide at 6 per cent of GDP in 2021, driving a further deterioration in fiscal strength, which will be most acute in Bahrain, Oman and Saudi Arabia,” said Alexander Perjessy an analyst at Moody’s.

Debt burden

Increase in debt burdens for GCC sovereigns will be among the largest globally. “We forecast that debt will rise on average by around 21 percentage points of GDP over 2019-21 across the GCC, compared with an average of 12 percentage points for emerging markets and 14 percentage points for advanced economies,” said Perjessy.

GCC governments with relatively high fiscal breakevens, including Bahrain and Kuwait, will see the largest increases of 33.8 percentage points and 37.5 percentage points respectively. The debt burdens of those with lower breakevens, such as Qatar and the UAE, will rise by only four percentage points and 11 percentage points respectively.

SWF buffers

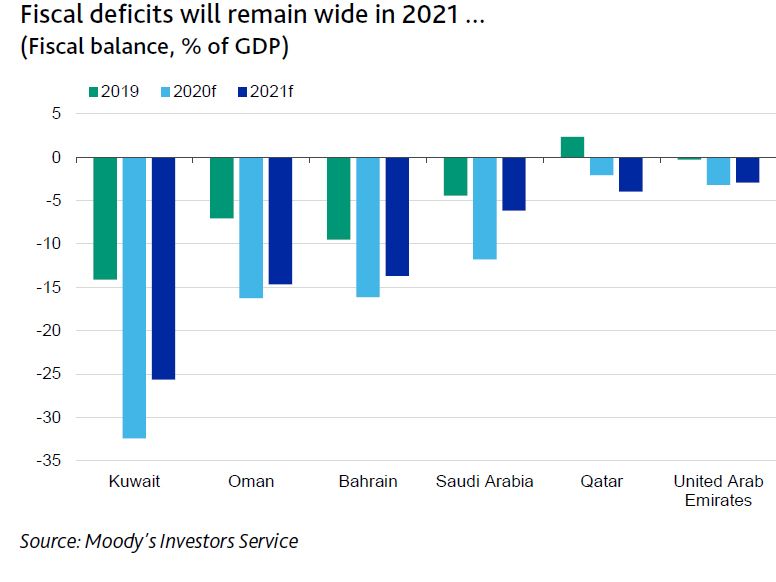

Sovereign Wealth Funds (SWF) will mitigate impact of higher gross debt burdens of GCC countries. While analysts expect that the largest rise in debt burden will be in Kuwait, the government’s exceptionally strong balance sheet will mitigate the impact on fiscal strength.

“While the UAE’s and Qatar’s SWF assets will remain smaller than Kuwait’s relative to GDP at 124 per cent and 163 per cent respectively, their fiscal deficits are also much narrower. This implies that their SWF assets would cover deficit spending for a much longer period of time than in Kuwait,” said Best

In Saudi Arabia and Oman, government debt burdens now exceed the SWF asset stock, and Moody’s expects the net asset positions to fall to negative balances of 18 per cent and 65 per cent of GDP by 2021.